Page 111 - CCB_Annual Report_2022

P. 111

110 Notes to the Financial Statements 111

All properties are individually valued at origination, The Bank’s total lending portfolio (by number of As the Bank has to date incurred limited arrears to a PD using a default curve based on historic

and regular reports are produced to ensure the accounts) falls into the following concentration by and losses in its initial ten years of trading, it has performance, management judgement and

property continues to represent suitable security loan size: had to use significant management judgement in industry benchmarking.

throughout the life of the loan. Affordability calibrating the weightings and values. Over time – Loss given default (LGD) is the magnitude of the

assessments are also performed on all loans, and Loan size 2022 2021 as the Bank obtains more performance data, it will likely loss if there is a default. The Bank estimates

other forms of security are often obtained, such as continue to develop its models and incorporate this the LGD parameters based on the history of

personal guarantees. 0 – £250k 47% 61% performance data into them.

recovery rates of claims against defaulted

Real Estate Loans are secured on properties £251k – £500k 24% 18% The payment status of the Bank’s loans and counter parties and management experience.

solely located in the UK, concentration risks are £501k – £1,000k 16% 11% advances are a key driver of the Bank’s provisioning The Bank calculates its real estate LGD using the

monitored, and credit exposures are diversified by requirements. The table below provides information drivers of the loan to value ratio (LTV).

sector and geography. £1,001k – £3,000k 10% 8% on the payment due status of loans and advances to The LGD is calculated at the current point in time

customers as at 31 December:

The Bank retains the ownership of all assets £3,001k+ 3% 2% and is then adjusted to reflect forward looking

financed by hire purchase and finance leases. economic indicators with the calculated loss

Total 100% 100%

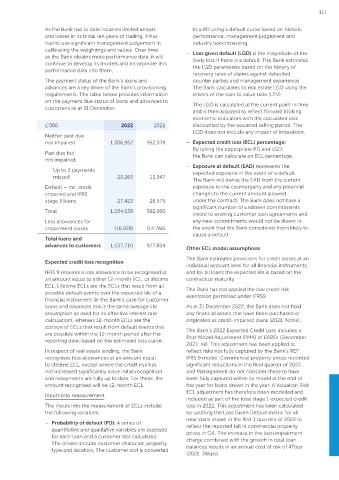

Concentration of credit risk £’000 2022 2021 discounted by the assumed selling period. The

LGD does not include any impact of indexation.

Neither past due

The Bank monitors concentration of credit risk by LTV banding nor impaired 1,006,952 952,078 – Expected credit loss (ECL) percentage:

product type, borrower type, geographic location The Bank’s real estate lending balances falls into the By taking the appropriate PD and LGD,

and loan size. Past due but

following LTV bandings: the Bank can calculate an ECL percentage.

not impaired:

– Exposure at default (EAD) represents the

Lending by product and type % 2022 2021 Up to 3 payments

LTV banding 2022 2021 expected exposure in the event of a default.

Commercial real estate lending missed 20,263 11,947 The Bank will derive the EAD from the current

0 – 50% 30% 29%

Residential 29% 33% Default – inc. credit exposure to the counterparty and any potential

51 – 60% 31% 30% impaired and IFRS changes to the current amount allowed

Commercial 58% 55% stage 3 loans 27,423 28,575 under the contract. The Bank does not have a

61 – 70% 36% 38%

Other 2% 3% Total 1,054,638 992,600 significant number of undrawn commitments

71 – 80% 1% 2% linked to existing customer loan agreements and

Asset finance 7% 5% Less allowances for any new commitments would not be drawn in

81%+ 2% 1%

impairment losses (16,928) (14,766) the event that the Bank considered them likely to

Classic Vehicles and Sports 4% 4%

Total 100% 100% cause a default.

Total 100% 100% Total loans and

advances to customers 1,037,710 977,834 Other ECL model assumptions

Credit risk – security

The Bank’s lending real estate portfolio is The Bank enters into loan agreements with Expected credit loss recognition The Bank estimates provisions for credit losses at an

geographically diversified across the UK: individual account level for all financial instruments,

customers, and where appropriate takes security. IFRS 9 requires a loss allowance to be recognised at and for all loans the expected life is based on the

The security profile of the loan’s receivable book is contractual maturity.

Region 2022 2021 shown below: an amount equal to either 12-month ECL, or lifetime

ECL. Lifetime ECLs are the ECLs that result from all The Bank has not applied the low credit risk

East Anglia 2% 2% possible default events over the expected life of a exemption permitted under IFRS9.

2022 2021 financial instrument (in the Bank’s case for customer

East Midlands 19% 15% loans and advances this is the same average life As at 31 December 2022, the Bank does not hold

£m % £m %

Greater London 4% 4% assumption as used for its effective interest rate any financial assets that have been purchased or

Secured on property 942 89 901 91 calculation), whereas 12-month ECLs are the originated as credit-impaired loans (2021: None).

North East 6% 4% portion of ECLs that result from default events that

Secured on The Bank’s 2022 Expected Credit Loss includes a

North West 16% 20% are possible within the 12-month period after the

other assets 113 11 92 9 Post Model Adjustment (PMA) of £685k (December

reporting date, based on the estimated loss curve.

Scotland 6% 7% 2021: nil). This adjustment has been applied to

Total 1,055 100 993 100

In respect of real estate lending, the Bank reflect risks not fully captured by the Bank’s REF

South East 7% 9%

recognises loss allowances at an amount equal IFRS 9 model. Commercial property prices recorded

South West 6% 5% In addition to security over property, the Bank may to lifetime ECL, except where the credit risk has significant reductions in the final quarter of 2022

also take additional security in the form of Director not increased significantly since initial recognition and Management do not consider these to have

Wales 6% 7%

Guarantees and cash deposits. Collateralised and repayments are fully up to date. For these, the been fully captured within its model at the end of

West Midlands 7% 8% deposits at the end of 2022 totalled £1.4m amount recognised will be 12-month ECL. the year for loans drawn in the year. A Valuation Risk

(2021: £1.3m). ECL adjustment has therefore been modelled and

Yorkshire/Humberside 21% 19% Inputs into measurement included as part of the total stage 1 expected credit

Credit risk – allowance for impairment losses

Total 100% 100% The inputs into the measurement of ECLs include loss in 2022. This adjustment has been calculated

(see also Note 16) the following variables: by uplifting the Loss Given Default metric for all

new loans drawn in the first 3 quarters of 2022 to

The Bank uses a forward-looking ‘expected credit – Probability of default (PD): A series of reflect the reported fall in commercial property

loss’ (ECL) model to assess its credit risk. This quantitative and qualitative variables are assessed prices in Q4. The increase in the loan impairment

requires considerable management judgement over for each loan and a customer slot calculated. charge combined with the growth in total loan

how changes in economic factors affect ECLs, which The drivers include customer character, property balances results in an annual cost of risk of 47bps

are determined on a probability-weighted basis. type and location. The customer slot is converted

(2021: 38bps).