Page 113 - CCB_Annual Report_2022

P. 113

112 Notes to the Financial Statements 113

Definition of default Credit risk grades

IFRS 9 Provisioning

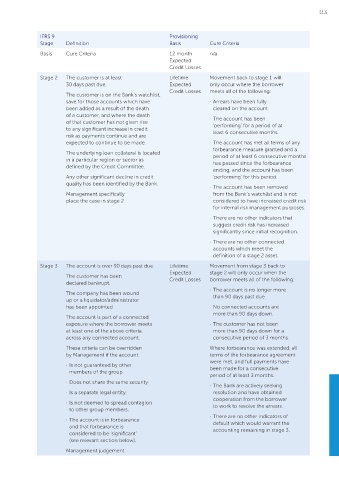

The Bank defines default where the loan is in arrears The Bank allocates each exposure a credit risk grade Stage Definition Basis Cure Criteria

for four or more consecutive payments (i.e. over (slot) using its Credit Grading Model. Each exposure

90 days), the loan is linked to another account in has been allocated a credit risk grade on initial Basis Cure Criteria 12 month n/a

default, the customer has been declared bankrupt, recognition. Credit grades are formally reviewed Expected

or the company has been wound up, or a liquidator/ as a minimum on an annual basis. The grades are Credit Losses

administrator appointed. This is aligned to the reassessed earlier if the customer falls into arrears Stage 2 The customer is at least Lifetime Movement back to stage 1 will

regulatory definition of default. or contacts the Bank with information that impacts

its credit quality. 30 days past due. Expected only occur where the borrower

Write‑off The customer is on the Bank’s watchlist, Credit Losses meets all of the following:

The table below presents the Bank’s loan portfolio

A write-off is a direct reduction in a financial assets split by slot. Each loan account is allocated a save for those accounts which have · Arrears have been fully

been added as a result of the death

cleared on the account.

gross carrying value when there is no reasonable slot between 1 and 4, with accounts in default of a customer, and where the death

expectation of recovering the financial asset in its allocated a slot 5. of that customer has not given rise · The account has been

entirety or a portion thereof. A write-off therefore to any significant increase in credit ‘performing’ for a period of at

constitutes a derecognition event. The Bank wrote- Lending split risk as payments continue and are least 6 consecutive months.

off £2.9m of loans in 2022 (2021: £1.4m). The Bank by slot as at expected to continue to be made. · The account has met all terms of any

has experienced a total of 23 write-offs on its REF 31 December Stage 1 Stage 2 Stage 3 Total forbearance measure granted and a

portfolio and 14 write-offs on its AF portfolio since 2022 (£m) (£m) (£m) (£m) The underlying loan collateral is located period of at least 6 consecutive months

its inception in 2012. The Bank will write off all or in a particular region or sector as has passed since the forbearance

part of the gross carrying amount of a financial 1 – 2 571 – – 571 defined by the Credit Committee. ending, and the account has been

asset under the following circumstances:

3 150 43 – 193 Any other significant decline in credit ‘performing’ for this period.

– Where the underlying collateral of a loan has 4 40 114 – 154 quality has been identified by the Bank. · The account has been removed

been sold, with the proceeds having been Management specifically from the Bank’s watchlist and is not

received by the Bank, and there is no reasonable 5 – – 24 24 place the case in stage 2 considered to have increased credit risk

expectation of recovering the remainder of the Real Estate for internal risk management purposes.

outstanding balance due;

Gross loans* 761 157 24 942

– The write-off has been approved in line with the · There are no other indicators that

Asset Finance suggest credit risk has increased

Bank’s policy; and

Gross loan* 104 5 4 113 significantly since initial recognition.

– The Bank has explored reasonable avenues of

* Includes effective interest rate · There are no other connected

recovering the outstanding loan amount.

accounts which meet the

The release of provisions and the write-off The majority of slot 1 to 3 accounts relate to definition of a stage 2 asset.

of any bad debt is subject to appropriate performing loans where the loans are fully up to Stage 3 The account is over 90 days past due. Lifetime Movement from stage 3 back to

delegated authorities.

date and no significant change in credit risk has Expected stage 2 will only occur when the

been identified. The customer has been Credit Losses borrower meets all of the following:

declared bankrupt.

The majority of slot 4 loans are in stage 2 as a result · The account is no longer more

of accounts falling into arrears or other deteriorating The company has been wound than 90 days past due.

credit factors having been identified, and the up or a liquidator/administrator

account placed on the Bank’s Credit watch-list. has been appointed. · No connected accounts are

The account is part of a connected more than 90 days down.

All slot 5 customers are in stage 3 with the majority

categorised as being in default as a result of arrears exposure where the borrower meets · The customer has not been

in excess of 90 days. at least one of the above criteria more than 90 days down for a

across any connected account. consecutive period of 3 months.

The Bank’s Asset Finance and Classic Car exposures

are allocated a Probability of Default (PD) at These criteria can be overridden Where forbearance was extended, all

origination which is reviewed on a monthly basis. by Management if the account: terms of the forbearance agreement

The PD is calculated using the Moody’s Risk Calc · Is not guaranteed by other were met, and full payments have

system. The exposures are allocated an IFRS 9 stage members of the group. been made for a consecutive

depending on the status of the account and the period of at least 3 months.

PD. Accounts which have triggered the Bank’s SICR · Does not share the same security. · The Bank are actively seeking

(Significant Increase In Credit Risk) criteria or are · Is a separate legal entity. resolution and have obtained

over 30 days in arrears are as a minimum in stage 2. cooperation from the borrower

Accounts over 90 days in arrears or are considered · Is not deemed to spread contagion to work to resolve the arrears.

unlikely to pay are classified in stage 3. to other group members.

· The account is in forbearance · There are no other indicators of

Provisioning stages and that forbearance is default which would warrant the

considered to be ‘significant’ accounting remaining in stage 3.

Under IFRS 9 all the Bank’s lending exposures are

allocated a stage based on the current status of the (see relevant section below).

loan. The Bank has set the following definitions for Management judgement

each of the three stages within IFRS 9: