Page 25 - CCB_Annual Report_2022

P. 25

24 Strategic Report 25

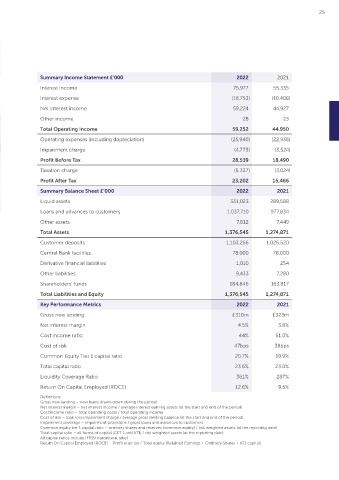

Financial review Summary Income Statement £’000 2022 2021

• The Bank has delivered a strong financial Interest income 75,977 55,335

performance in 2022 despite the Interest expense (16,753) (10,408)

deteriorating economic environment

evidenced during the year. Net interest income 59,224 44,927

• Net Interest income increased by £14m Other income 28 23

compared to the prior period as a Total Operating Income 59,252 44,950

result of the growth in customer loans

and advances and an increase in the Operating expenses (including depreciation) (25,940) (22,936)

net interest margin. Whilst pricing in

both the lending and deposit markets Impairment charge (4,773) (3,524)

remains competitive, the increases and Profit Before Tax 28,539 18,490

the timing of bank base rate rises, the

mix of the Bank’s loans and deposits in Taxation charge (5,337) (3,024)

terms of fixed and variable rates enabled Profit After Tax 23,202 15,466

the Bank to increase its NIM to 4.5%

(2021: 3.8%) and maintained a strong Summary Balance Sheet £’000 2022 2021

liquidity position with an LDR of 94% and Liquid assets 331,023 289,588

reported an LCR of 361% at the year end.

Loans and advances to customers 1,037,710 977,834

• The Bank’s loans and advances to

customers continue to perform with Other assets 7,812 7,449

low levels of defaults despite the • The Bank continues to maintain a strong Total Assets 1,376,545 1,274,871

deteriorating economic conditions. liquidity and capital position. At the end

The Bank is cognisant of the economic of December 2022, the Bank held liquid Customer deposits 1,103,256 1,025,520

uncertainty and this has resulted in its assets of over £331m with an LCR of Central Bank facilities 78,000 78,000

impairment loss charge increasing from 361%, significantly above the regulatory

£3.5m to £4.8m in 2022. Balance sheet requirement of 100%. The Bank’s total Derivative financial liabilities 1,010 254

provisions increased from £14.8m to capital ratio was 23.6% at the end of Other liabilities 9,433 7,280

£16.9m reflecting the growth in loan December with a CET1 ratio of 20.7%.

balances, and an increased impairment The Bank’s leverage ratio was 13.9%, Shareholders’ funds 184,846 163,817

coverage ratio of 1.6% (2021: 1.5%). significantly above the regulatory limit Total Liabilities and Equity 1,376,545 1,274,871

of 3.25%.

• Recognising that the Bank’s people Key Performance Metrics 2022 2021

are its key differentiator in achieving its • The Board are committed to continuing

service levels and customer support, to support our customers and the SME Gross new lending £310m £323m

the Board maintained their commitment market through the current economic Net interest margin 4.5% 3.8%

to invest in infrastructure, capacity, downturn. Despite the less favourable

and capability to ensure that the Bank operating environment the Board are Cost:income ratio 44% 51.0%

continues to develop the skills and planning for continued growth in the Cost of risk 47bps 38bps

expertise it needs to support both the Bank’s balance sheet as well as ongoing

current business demands and future investment in its people and systems. Common Equity Tier 1 capital ratio 20.7% 19.9%

growth aspirations. The average number The Bank’s performance is presented on a Total capital ratio 23.6% 23.0%

of employees increased by 13% to 206 statutory basis and structured consistently

during the year. Despite the continued with the key elements of the business Liquidity Coverage Ratio 361% 287%

investment in the business, the Bank model explained on page 13. The 2022 Return On Capital Employed (ROCE) 12.6% 9.5%

reduced the cost income ratio from financial statements have been prepared

51.0% in 2021 to 44% in 2022. Definitions:

under UK-adopted international financial Gross new lending – new loans drawn down during the period

• Despite the challenging conditions reporting standards (IFRS). The Bank’s Net interest margin – net interest income / average interest earning assets (at the start and end of the period)

Cost:income ratio – total operating costs / total operating income

the Board are pleased with the Bank’s primary financial statements are reported Cost of risk – loan loss impairment charge / average gross lending balance (at the start and end of the period)

performance delivering Profit after tax on pages 84 – 87, with a summary of these Impairment coverage – impairment provisions / gross loans and advances to customers

of £23.2m (2021: £15.5m) and ROCE of shown below. There have been no changes Common equity tier 1 capital ratio – ordinary shares and reserves (common equity) / risk weighted assets (at the reporting date)

Total capital ratio – all forms of capital (CET 1 and AT1) / risk weighted assets (at the reporting date)

12.6% (2021: 9.5%). in the Bank’s accounting policies in 2022. All capital ratios include IFRS9 transitional relief

Return On Capital Employed (ROCE) – Profit after tax / Total equity (Retained Earnings + Ordinary Shares + AT1 capital)