Page 29 - CCB_Annual Report_2022

P. 29

28 Strategic Report 29

Impairment Taxation

The taxation charge of £5.3m (2021:

£’000 2022 2021 £3.0m), reflects an effective corporation

tax rate of 19% (2021: 19%). The taxation

Value of loans past due – 20,263 11,947 charge includes a £176k charge (2021:

Up to 3 payments missed

£141k credit) in respect of deferred tax,

Value of loans in default – 27,423 28,575 and a credit of £274k in respect of the

inc. credit impaired and IFRS 9 stage 3 loans Bank’s convertible loan note interest

payment (2021: £244k).

Impairment loan provisions 16,928 14,766

Dividends and convertible loan

The Bank’s asset quality remains strong related weightings, are provided in Note 28. note payments

and it continued to successfully manage The Bank continues to review all its IFRS 9 The Bank paid a £1.4m coupon on 30

its defaulted loan cases throughout 2022, model assumptions on a regular basis to September 2022 (2021: £1.3m) in interest

despite the uncertain economic and ensure they reflect actual performance as payments on the convertible loan notes to

market environment. well as management’s future expectations. Cambridgeshire County Council Pension

The Bank’s 2022 Expected Credit Loss

The Bank has always ensured that its includes a Post Model Adjustment (PMA) of Fund, the holder of the loan notes.

customers could potentially service £685k (December 21: nil). This adjustment The Board did not pay an ordinary share

increased levels of repayments with

has been applied to reflect risks not fully dividend in 2022 and does not propose

applicant’s affordability stressed at higher

captured by the Bank’s REF IFRS 9 model. an ordinary share dividend in 2023 as

than current Bank base rate. The Bank has

Commercial property prices recorded it continues to focus on maintaining a

also maintained its loan to value limits with

significant reductions in the final quarter strong, well-capitalised balance sheet.

the average LTV on the Real estate book at

of 2022 and Management do not consider

31 December 2022 being 56% (2021: 56%).

these to have been fully captured within Shareholders’ funds

The Bank’s balance sheet impairment its model at the end of the year for loans

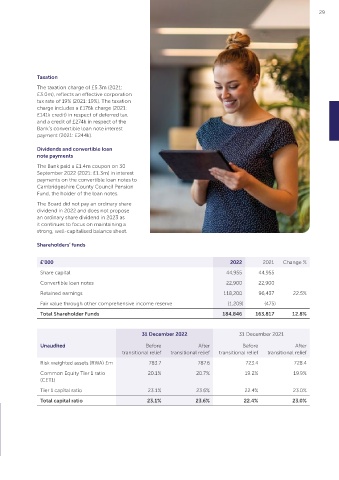

provision increased from £14.8m to £16.9m drawn in the year. A Valuation Risk ECL £’000 2022 2021 Change %

in 2022. The Bank’s loan loss provision adjustment has therefore been modelled

coverage ratio increased to 1.6% during the and included as part of the total stage Share capital 44,955 44,955

year (2021: 1.5%). 1 expected credit loss in 2022. This Convertible loan notes 22,900 22,900

adjustment has been calculated by uplifting

The IFRS 9 calculated income statement

the Loss Given Default metric for all new Retained earnings 118,200 96,437 22.5%

impairment charge was £4.8m in 2022,

loans drawn in the first 3 quarters of 2022

an increase of £1.3m compared to 2021. Fair value through other comprehensive income reserve (1,209) (475)

to reflect the reported fall in commercial

The charge reflects write-offs of balances

property prices in Q4. The increase in the Total Shareholder Funds 184,846 163,817 12.8%

totalling £2.9m, recoveries on previously loan impairment charge combined with the

written-off accounts of £0.1m and new growth in total loan balances results in an

provisions of £2.0m. The number and annual cost of risk of 47bps (2021: 38bps). 31 December 2022 31 December 2021

balances of the Bank’s stage 3 loans (the

majority of which are in default) remains The Bank is very aware of the potential Unaudited Before After Before After

broadly similar year on year. impact of the current economic transitional relief transitional relief transitional relief transitional relief

environment on its customer’s businesses.

The impairment charge is calculated using The Bank remains committed, as it Risk weighted assets (RWA) £m 783.7 787.6 723.4 728.4

the Bank’s granular credit grading and did during Covid-19, to supporting its

IFRS9 impairment models. The models customers through this less favourable and Common Equity Tier 1 ratio 20.1% 20.7% 19.2% 19.9%

include forward looking economic more volatile economic environment. (CET1)

scenarios. The scenarios, together with the Tier 1 capital ratio 23.1% 23.6% 22.4% 23.0%

Total capital ratio 23.1% 23.6% 22.4% 23.0%

Leveraging manual underwriting to

navigate the macroeconomic outlook