Page 32 - CCB_Annual Report_2022

P. 32

32 Strategic Report 33

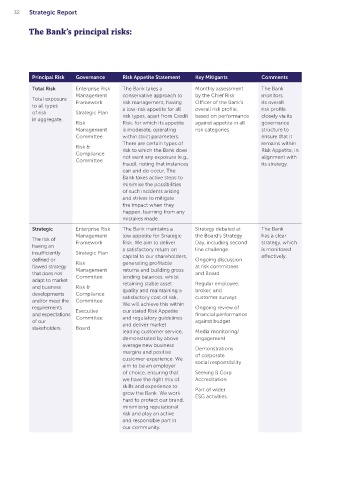

The Bank’s principal risks:

Principal Risk Governance Risk Appetite Statement Key Mitigants Comments Principal Risk Governance Risk Appetite Statement Key Mitigants Comments

Total Risk Enterprise Risk The Bank takes a Monthly assessment The Bank Capital Capital The Bank maintains a Maintaining a capital The Bank

Management conservative approach to by the Chief Risk monitors Adequacy Management low appetite for Capital surplus buffer exceeding maintains and

Total exposure

Framework risk management, having Officer of the Bank’s its overall Policy Adequacy Risk. Our minimum regulatory monitors a

to all types a low-risk appetite for all overall risk profile, risk profile The risk that priority is to maintain requirements robust capital

of risk Strategic Plan risk types, apart from Credit based on performance closely via its the Bank Asset & Liabilities (via retained earnings) base, including

in aggregate. fails to hold Committee Ongoing forecasting

Risk Risk, for which its appetite against appetite in all governance a capital surplus above a management

Management is moderate, operating risk categories. structure to sufficient Risk & CET1 and Total Capital of capital requirements buffer more

Committee within strict parameters. ensure that it capital to meet Compliance requirements sufficient to reported to risk than regulatory

There are certain types of remains within its regulatory Committee absorb any unexpected committees. requirements.

Risk & risk to which the Bank does Risk Appetite, in obligations,

Compliance not want any exposure (e.g., alignment with support Executive losses and costs without Quarterly stress testing

Committee its growth Committee using regulatory buffers Annual ICAAP,

fraud), noting that instances its strategy. and ensure that the Bank’s

can and do occur. The plans or to Board capital base can support incorporating regular

Bank takes active steps to absorb shocks. a growing and maturing stress testing of the

minimise the possibilities book throughout the capital base in ‘severe yet

of such incidents arising economic cycle, allowing plausible’ scenarios.

and strives to mitigate for potential downturns. Horizon scanning

the impact when they to ensure continued

happen, learning from any compliance with

mistakes made. regulatory requirements

Strategic Enterprise Risk The Bank maintains a Strategy debated at The Bank Liquidity & Asset-Liability The Bank maintains a Measuring, managing, The Bank

Management low appetite for Strategic the Board’s Strategy has a clear Funding Management low-risk appetite for and monitoring the risk maintains

The risk of Framework Risk. We aim to deliver Day, including second strategy, which

having an a satisfactory return on line challenge. is monitored The risk of Policy Liquidity & Funding Risk. over appropriate time and monitors

insufficiently Strategic Plan capital to our shareholders, effectively. being unable Savings We will maintain sufficient horizons, including its liquidity

defined or Risk generating profitable Ongoing discussion to fund assets Protocols liquid assets to meet intra-day and funding

flawed strategy Management returns and building gross at risk committees and meet liabilities as they fall due Regular reforecasting of requirements

that does not Committee lending balances, whilst and Board obligations Asset & Liabilities in a stressed scenario and the liquidity positions on a regular

adapt to market retaining stable asset Regular employee, as they fall Committee always maintain a buffer, basis, including

and business Risk & quality and maintaining a broker, and due, without Risk & including satisfactory Monitoring strict criteria intra-day risk

developments Compliance satisfactory cost of risk. customer surveys incurring Compliance liquidity coverage and loan over the use of High and maintains

and/or meet the Committee We will achieve this within unacceptable Committee to deposit ratios. We will Quality Liquid Assets sufficient

requirements Executive our stated Risk Appetite Ongoing review of losses. ensure that we are not Annual ILAAP, including liquidity

and expectations Committee and regulatory guidelines financial performance Liquidity overly reliant upon any stress testing of the headroom to

of our and deliver market against budget Contingency single savings intermediary liquidity base in ‘severe ensure that

stakeholders. Board Plan to raise deposits. yet plausible’ scenarios. the Board’s

leading customer service, Media monitoring/ risk appetite

demonstrated by above engagement Horizon scanning and regulatory

average new business Demonstrations to ensure continued requirements

margins and positive of corporate compliance with are always met.

customer experience. We social responsibility regulatory requirements

aim to be an employer Market

of choice, ensuring that Seeking B Corp Interest Rate Risk The Bank has no appetite Scenario analysis Market Risk

we have the right mix of Accreditation The risk that in the Bank Book for foreign currency risk Use of natural balance is limited

to Interest

skills and experience to Part of wider changes in Policy and a low appetite for sheet hedges and Rate Risk in

grow the Bank. We work ESG activities. market rates Asset & Liabilities interest rate and basis derivatives when needed. the Banking

hard to protect our brand, negatively Committee risk keeping all assets, Book, which

minimising reputational impact the liabilities and off-balance Monitoring of pipeline, is monitored

risk and play an active earnings Risk & sheet exposures in repayment profiles and by the Bank’s

and responsible part in or market Compliance sterling and carefully product maturities. ALCO and a

our community. value of the Committee managing mismatches Modelling a variety of suite of Key

Bank’s assets between tenors of loans different yield curves/ Risk Indicators

and deposits, hedging

or liabilities. interest rate paths.

exposures where and tested

necessary within pre- via scenario

determined limits. analysis.