Page 101 - 86395_CCB - 2024 Annual Report (web)

P. 101

101

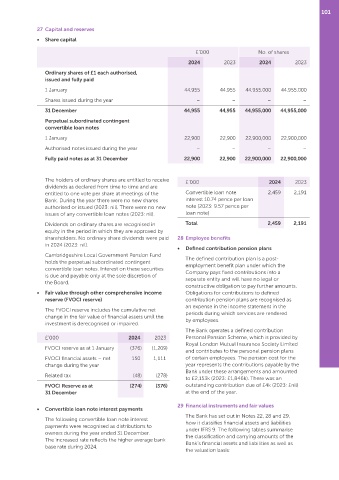

27 Capital and reserves

• Share capital

£’000 No. of shares

2024 2023 2024 2023

Ordinary shares of £1 each authorised,

issued and fully paid

1 January 44,955 44,955 44,955,000 44,955,000

Shares issued during the year – – – –

31 December 44,955 44,955 44,955,000 44,955,000

Perpetual subordinated contingent

convertible loan notes

1 January 22,900 22,900 22,900,000 22,900,000

Authorised notes issued during the year – – – –

Fully paid notes as at 31 December 22,900 22,900 22,900,000 22,900,000

The holders of ordinary shares are entitled to receive £’000 2024 2023

dividends as declared from time to time and are

entitled to one vote per share at meetings of the Convertible loan note 2,459 2,191

Bank. During the year there were no new shares interest 10.74 pence per loan

authorised or issued (2023: nil). There were no new note (2023: 9.57 pence per

issues of any convertible loan notes (2023: nil). loan note)

Dividends on ordinary shares are recognised in Total 2,459 2,191

equity in the period in which they are approved by

shareholders. No ordinary share dividends were paid 28 Employee benefits

in 2024 (2023: nil).

• Defined contribution pension plans

Cambridgeshire Local Government Pension Fund The defined contribution plan is a post‑

holds the perpetual subordinated contingent employment benefit plan under which the

convertible loan notes. Interest on these securities Company pays fixed contributions into a

is due and payable only at the sole discretion of separate entity and will have no legal or

the Board.

constructive obligation to pay further amounts.

• Fair value through other comprehensive income Obligations for contributions to defined

reserve (FVOCI reserve) contribution pension plans are recognised as

an expense in the income statement in the

The FVOCI reserve includes the cumulative net periods during which services are rendered

change in the fair value of financial assets until the

by employees.

investment is derecognised or impaired.

The Bank operates a defined contribution

£’000 2024 2023 Personal Pension Scheme, which is provided by

Royal London Mutual Insurance Society Limited

FVOCI reserve as at 1 January (376) (1,209)

and contributes to the personal pension plans

FVOCI financial assets – net 150 1,111 of certain employees. The pension cost for the

change during the year year represents the contributions payable by the

Bank under these arrangements and amounted

Related tax (48) (278)

to £2,153k (2023: £1,846k). There was an

FVOCI Reserve as at (274) (376) outstanding contribution due of £4k (2023: £nil)

31 December at the end of the year.

29 Financial instruments and fair values

• Convertible loan note interest payments

The Bank has set out in Notes 22, 28 and 29,

The following convertible loan note interest

how it classifies financial assets and liabilities

payments were recognised as distributions to

under IFRS 9. The following tables summarise

owners during the year ended 31 December.

the classification and carrying amounts of the

The increased rate reflects the higher average bank

Bank’s financial assets and liabilities as well as

base rate during 2024.

the valuation basis: