Page 97 - 86395_CCB - 2024 Annual Report (web)

P. 97

97

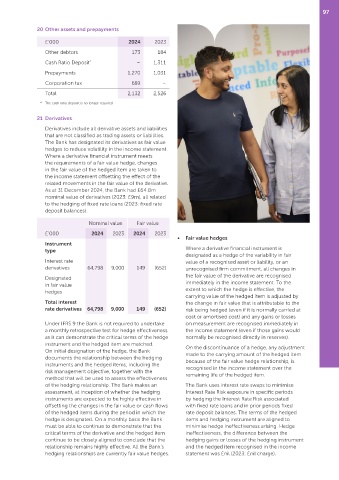

20 Other assets and prepayments

£’000 2024 2023

Other debtors 173 184

Cash Ratio Deposit * – 1,311

Prepayments 1,270 1,031

Corporation tax 689 –

Total 2,132 2,526

* The cash ratio deposit is no longer required

21 Derivatives

Derivatives include all derivative assets and liabilities

that are not classified as trading assets or liabilities.

The Bank has designated its derivatives as fair value

hedges to reduce volatility in the income statement.

Where a derivative financial instrument meets

the requirements of a fair value hedge, changes

in the fair value of the hedged item are taken to

the income statement offsetting the effect of the

related movements in the fair value of the derivative.

As at 31 December 2024, the Bank had £64.8m

nominal value of derivatives (2023: £9m), all related

to the hedging of fixed rate loans (2023: fixed rate

deposit balances).

Nominal value Fair value

£’000 2024 2023 2024 2023

• Fair value hedges

Instrument

type Where a derivative financial instrument is

designated as a hedge of the variability in fair

Interest rate value of a recognised asset or liability, or an

derivatives 64,798 9,000 149 (652) unrecognised firm commitment, all changes in

the fair value of the derivative are recognised

Designated

in fair value immediately in the income statement. To the

hedges extent to which the hedge is effective, the

carrying value of the hedged item is adjusted by

Total interest the change in fair value that is attributable to the

rate derivatives 64,798 9,000 149 (652) risk being hedged (even if it is normally carried at

cost or amortised cost) and any gains or losses

Under IFRS 9 the Bank is not required to undertake on measurement are recognised immediately in

a monthly retrospective test for hedge effectiveness the income statement (even if those gains would

as it can demonstrate the critical terms of the hedge normally be recognised directly in reserves).

instrument and the hedged item are matched.

On the discontinuance of a hedge, any adjustment

On initial designation of the hedge, the Bank

made to the carrying amount of the hedged item

documents the relationship between the hedging

because of the fair value hedge relationship, is

instruments and the hedged items, including the

recognised in the income statement over the

risk management objective, together with the

remaining life of the hedged item.

method that will be used to assess the effectiveness

of the hedging relationship. The Bank makes an The Bank uses interest rate swaps to minimise

assessment, at inception of whether the hedging Interest Rate Risk exposure in specific periods

instruments are expected to be highly effective in by hedging the Interest Rate Risk associated

offsetting the changes in the fair value or cash flows with fixed rate loans and in prior periods fixed

of the hedged items during the period in which the rate deposit balances. The terms of the hedged

hedge is designated. On a monthly basis the Bank items and hedging instrument are aligned to

must be able to continue to demonstrate that the minimise hedge ineffectiveness arising. Hedge

critical terms of the derivative and the hedged item ineffectiveness, the difference between the

continue to be closely aligned to conclude that the hedging gains or losses of the hedging instrument

relationship remains highly effective. All the Bank’s and the hedged item recognised in the income

hedging relationships are currently fair value hedges. statement was £nil (2023: £nil charge).