Page 96 - 86395_CCB - 2024 Annual Report (web)

P. 96

96

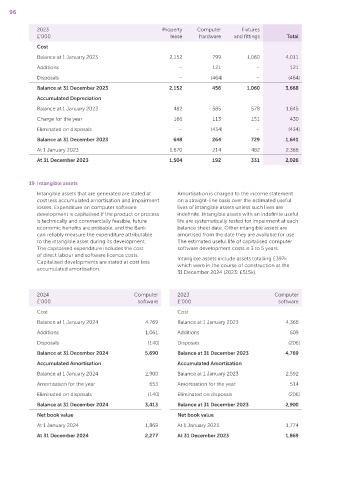

2023 Property Computer Fixtures

£’000 lease hardware and fittings Total

Cost

Balance at 1 January 2023 2,152 799 1,060 4,011

Additions – 121 – 121

Disposals – (464) – (464)

Balance at 31 December 2023 2,152 456 1,060 3,668

Accumulated Depreciation

Balance at 1 January 2023 482 585 578 1,645

Charge for the year 166 113 151 430

Eliminated on disposals – (434) – (434)

Balance at 31 December 2023 648 264 729 1,641

At 1 January 2023 1,670 214 482 2,366

At 31 December 2023 1,504 192 331 2,026

19 Intangible assets

Intangible assets that are generated are stated at Amortisation is charged to the income statement

cost less accumulated amortisation and impairment on a straight‑line basis over the estimated useful

losses. Expenditure on computer software lives of intangible assets unless such lives are

development is capitalised if the product or process indefinite. Intangible assets with an indefinite useful

is technically and commercially feasible, future life are systematically tested for impairment at each

economic benefits are probable, and the Bank balance sheet date. Other intangible assets are

can reliably measure the expenditure attributable amortised from the date they are available for use.

to the intangible asset during its development. The estimated useful life of capitalised computer

The capitalised expenditure includes the cost software development costs is 3 to 5 years.

of direct labour and software licence costs. Intangible assets include assets totalling £397k

Capitalised developments are stated at cost less which were in the course of construction at the

accumulated amortisation.

31 December 2024 (2023: £515k).

2024 Computer 2023 Computer

£’000 software £’000 software

Cost Cost

Balance at 1 January 2024 4,769 Balance at 1 January 2023 4,366

Additions 1,061 Additions 609

Disposals (140) Disposals (206)

Balance at 31 December 2024 5,690 Balance at 31 December 2023 4,769

Accumulated Amortisation Accumulated Amortisation

Balance at 1 January 2024 2,900 Balance at 1 January 2023 2,592

Amortisation for the year 653 Amortisation for the year 514

Eliminated on disposals (140) Eliminated on disposals (206)

Balance at 31 December 2024 3,413 Balance at 31 December 2023 2,900

Net book value Net book value

At 1 January 2024 1,869 At 1 January 2023 1,774

At 31 December 2024 2,277 At 31 December 2023 1,869