Page 98 - 86395_CCB - 2024 Annual Report (web)

P. 98

98

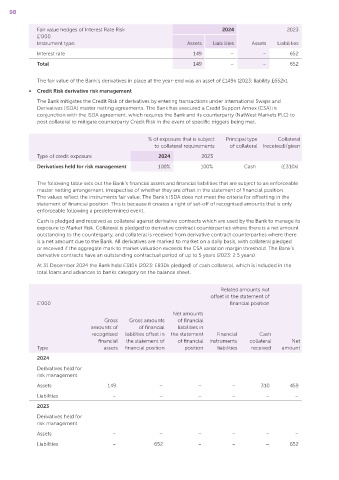

Fair value hedges of Interest Rate Risk 2024 2023

£’000

Instrument type: Assets Liabilities Assets Liabilities

Interest rate 149 – – 652

Total 149 – – 652

The fair value of the Bank’s derivatives in place at the year‑end was an asset of £149k (2023: liability £652k).

• Credit Risk derivative risk management

The Bank mitigates the Credit Risk of derivatives by entering transactions under International Swaps and

Derivatives (ISDA) master netting agreements. The Bank has executed a Credit Support Annex (CSA) in

conjunction with the ISDA agreement, which requires the Bank and its counterparty (NatWest Markets PLC) to

post collateral to mitigate counterparty Credit Risk in the event of specific triggers being met.

% of exposure that is subject Principal type Collateral

to collateral requirements of collateral (received)/given

Type of credit exposure 2024 2023

Derivatives held for risk management 100% 100% Cash (£310k)

The following table sets out the Bank’s financial assets and financial liabilities that are subject to an enforceable

master netting arrangement, irrespective of whether they are offset in the statement of financial position.

The values reflect the instruments fair value. The Bank’s ISDA does not meet the criteria for offsetting in the

statement of financial position. This is because it creates a right of set‑off of recognised amounts that is only

enforceable following a predetermined event.

Cash is pledged and received as collateral against derivative contracts which are used by the Bank to manage its

exposure to Market Risk. Collateral is pledged to derivative contract counterparties where there is a net amount

outstanding to the counterparty, and collateral is received from derivative contract counterparties where there

is a net amount due to the Bank. All derivatives are marked to market on a daily basis, with collateral pledged

or received if the aggregate mark to market valuation exceeds the CSA variation margin threshold. The Bank’s

derivative contracts have an outstanding contractual period of up to 5 years (2023: 2.5 years).

At 31 December 2024 the Bank held £310k (2023: £830k pledged) of cash collateral, which is included in the

total loans and advances to banks category on the balance sheet.

Related amounts not

offset in the statement of

£’000 financial position

Net amounts

Gross Gross amounts of financial

amounts of of financial liabilities in

recognised liabilities offset in the statement Financial Cash

financial the statement of of financial instruments collateral Net

Type assets financial position position liabilities received amount

2024

Derivatives held for

risk management

Assets 149 – – – 310 459

Liabilities – – – – – –

2023

Derivatives held for

risk management

Assets – – – – – –

Liabilities – 652 – – – 652