Page 99 - 86395_CCB - 2024 Annual Report (web)

P. 99

99

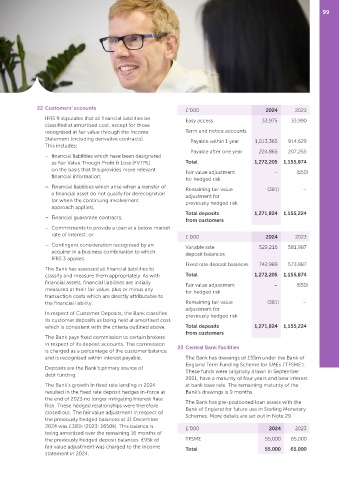

22 Customers’ accounts £’000 2024 2023

IFRS 9 stipulates that all financial liabilities be Easy access 33,975 33,990

classified at amortised cost, except for those

recognised at fair value through the Income Term and notice accounts

Statement (including derivative contracts). Payable within 1 year 1,013,365 914,629

This includes:

Payable after one year 224,865 207,255

– financial liabilities which have been designated

as Fair Value Though Profit & Loss (FVTPL) Total 1,272,205 1,155,874

on the basis that this provides more relevant Fair value adjustment – (650)

financial information;

for hedged risk

– Financial liabilities which arise when a transfer of Remaining fair value (381) –

a financial asset do not qualify for derecognition adjustment for

(or when the continuing involvement previously hedged risk

approach applies);

Total deposits 1,271,824 1,155,224

– Financial guarantee contracts;

from customers

– Commitments to provide a loan at a below market

rate of interest; or £’000 2024 2023

– Contingent consideration recognised by an Variable rate 529,216 581,987

acquirer in a business combination to which deposit balances

IFRS 3 applies.

Fixed rate deposit balances 742,989 573,887

The Bank has assessed all financial liabilities to

classify and measure them appropriately. As with Total 1,272,205 1,155,874

financial assets, financial liabilities are initially Fair value adjustment – (650)

measured at their fair value, plus or minus any for hedged risk

transaction costs which are directly attributable to

the financial liability. Remaining fair value (381) –

adjustment for

In respect of Customer Deposits, the Bank classifies previously hedged risk

its customer deposits as being held at amortised cost,

which is consistent with the criteria outlined above. Total deposits 1,271,824 1,155,224

from customers

The Bank pays fixed commission to certain brokers

in respect of its deposit accounts. The commission 23 Central Bank Facilities

is charged as a percentage of the customer balance

and is recognised within interest payable. The Bank has drawings of £55m under the Bank of

England Term Funding Scheme for SMEs (‘TFSME’).

Deposits are the Bank’s primary source of These funds were originally drawn in September

debt funding.

2021, have a maturity of four years and bear interest

The Bank’s growth in fixed rate lending in 2024 at bank base rate. The remaining maturity of the

resulted in the fixed rate deposit hedges in‑force at Bank’s drawings is 9 months.

the end of 2023 no longer mitigating Interest Rate The Bank has pre‑positioned loan assets with the

Risk. These hedged relationships were therefore Bank of England for future use in Sterling Monetary

closed out. The fair value adjustment in respect of Schemes. More details are set out in Note 29.

the previously hedged balances at 31 December

2024 was £381k (2023: £650k). This balance is £’000 2024 2023

being amortised over the remaining 16 months of

the previously hedged deposit balances. £95k of TFSME 55,000 65,000

fair value adjustment was charged to the Income Total 55,000 65,000

statement in 2024.