Page 113 - 86395_CCB - 2024 Annual Report (web)

P. 113

113

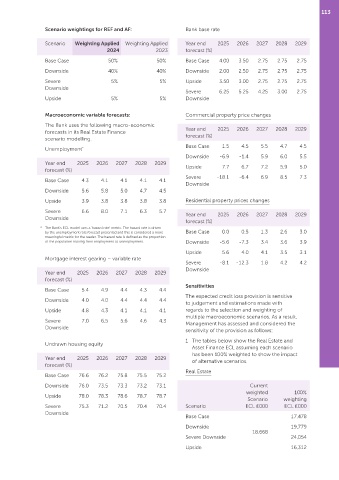

Scenario weightings for REF and AF: Bank base rate

Scenario Weighting Applied Weighting Applied Year end 2025 2026 2027 2028 2029

2024 2023 forecast (%)

Base Case 50% 50% Base Case 4.00 3.50 2.75 2.75 2.75

Downside 40% 40% Downside 2.00 2.50 2.75 2.75 2.75

Severe 5% 5% Upside 3.50 3.00 2.75 2.75 2.75

Downside

Severe 6.25 5.25 4.25 3.00 2.75

Upside 5% 5% Downside

Macroeconomic variable forecasts: Commercial property price changes

The Bank uses the following macro‑economic Year end 2025 2026 2027 2028 2029

forecasts in its Real Estate Finance forecast (%)

scenario modelling.

Base Case 1.5 4.5 5.5 4.7 4.5

Unemployment *

Downside ‑6.9 ‑1.4 5.9 6.0 5.5

Year end 2025 2026 2027 2028 2029

forecast (%) Upside 7.7 6.7 7.2 5.9 5.0

Severe ‑18.1 ‑6.4 6.9 8.5 7.3

Base Case 4.3 4.1 4.1 4.1 4.1

Downside

Downside 5.6 5.8 5.0 4.7 4.5

Upside 3.9 3.8 3.8 3.8 3.8 Residential property prices changes

Severe 6.6 8.0 7.1 6.3 5.7 Year end 2025 2026 2027 2028 2029

Downside

forecast (%)

* The Bank’s ECL model uses a ‘hazard rate’ metric. The hazard rate is driven

by the unemployment rate forecast presented and this is considered a more Base Case 0.0 0.5 1.3 2.6 3.0

meaningful metric for the reader. The hazard rate is defined as the proportion

of the population moving from employment to unemployment. Downside ‑5.6 ‑7.3 3.4 3.6 3.9

Upside 5.6 4.0 4.1 3.5 3.1

Mortgage interest gearing – variable rate

Severe ‑8.1 ‑12.3 1.8 4.2 4.2

Downside

Year end 2025 2026 2027 2028 2029

forecast (%)

Sensitivities

Base Case 5.4 4.9 4.4 4.3 4.4

The expected credit loss provision is sensitive

Downside 4.0 4.0 4.4 4.4 4.4

to judgement and estimations made with

Upside 4.8 4.3 4.1 4.1 4.1 regards to the selection and weighting of

multiple macroeconomic scenarios. As a result,

Severe 7.0 6.5 5.6 4.6 4.3 Management has assessed and considered the

Downside

sensitivity of the provision as follows:

1 The tables below show the Real Estate and

Undrawn housing equity

Asset Finance ECL assuming each scenario

has been 100% weighted to show the impact

Year end 2025 2026 2027 2028 2029 of alternative scenarios.

forecast (%)

Real Estate

Base Case 76.6 76.2 75.8 75.5 75.2

Downside 76.0 73.5 73.3 73.2 73.1 Current

weighted 100%

Upside 78.0 78.3 78.6 78.7 78.7

Scenario weighting

Severe 75.3 71.2 70.5 70.4 70.4 Scenario ECL £000 ECL £000

Downside

Base Case 17,478

Downside 19,779

18,668

Severe Downside 24,054

Upside 16,312