Page 95 - 86395_CCB - 2024 Annual Report (web)

P. 95

95

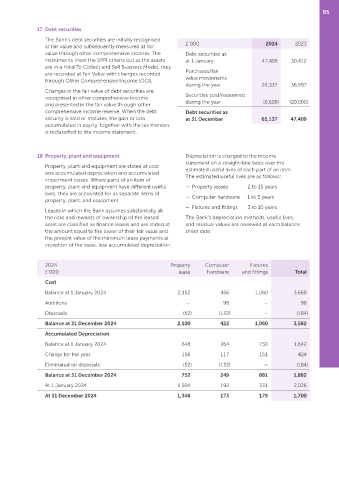

17 Debt securities

The Bank’s debt securities are initially recognised 2024

at fair value and subsequently measured at fair £’000 2023

value through other comprehensive income. The Debt securities as

instruments meet the SPPI criteria but as the assets at 1 January 47,409 30,412

are in a Held To Collect and Sell Business Model, they

are recorded at Fair Value with changes recorded Purchases/fair

through Other Comprehensive Income (OCI). value movements

during the year 24,337 36,997

Changes in the fair value of debt securities are

recognised in other comprehensive income Securities sold/redeemed

and presented in the fair value through other during the year (6,609) (20,000)

comprehensive income reserve. When the debt Debt securities as

security is sold or matures, the gain or loss at 31 December 65,137 47,409

accumulated in equity, together with the tax thereon,

is reclassified to the income statement.

18 Property, plant and equipment Depreciation is charged to the income

statement on a straight‑line basis over the

Property, plant and equipment are stated at cost

estimated useful lives of each part of an item.

less accumulated depreciation and accumulated

The estimated useful lives are as follows:

impairment losses. Where parts of an item of

property, plant and equipment have different useful – Property leases 2 to 15 years

lives, they are accounted for as separate items of

– Computer hardware 1 to 5 years

property, plant, and equipment.

– Fixtures and fittings 3 to 10 years

Leases in which the Bank assumes substantially all

the risks and rewards of ownership of the leased The Bank’s depreciation methods, useful lives,

asset are classified as finance leases and are stated at and residual values are reviewed at each balance

the amount equal to the lower of their fair value and sheet date.

the present value of the minimum lease payments at

inception of the lease, less accumulated depreciation.

2024 Property Computer Fixtures

£’000 lease hardware and fittings Total

Cost

Balance at 1 January 2024 2,152 456 1,060 3,668

Additions – 98 – 98

Disposals (52) (132) – (184)

Balance at 31 December 2024 2,100 422 1,060 3,582

Accumulated Depreciation

Balance at 1 January 2024 648 264 730 1,642

Charge for the year 156 117 151 424

Eliminated on disposals (52) (132) – (184)

Balance at 31 December 2024 752 249 881 1,882

At 1 January 2024 1,504 192 331 2,026

At 31 December 2024 1,348 173 179 1,700