Page 118 - CCB_Annual Report_2022

P. 118

118 Notes to the Financial Statements 119

Sensitivities The expected credit loss (ECL) on loans in stage

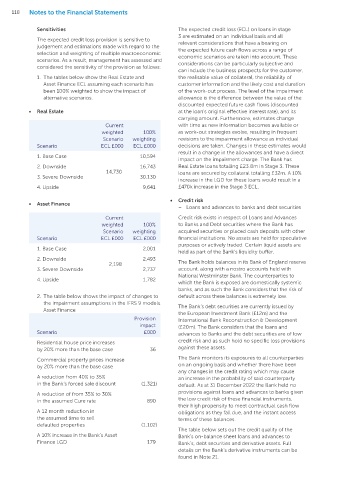

3 are estimated on an individual basis and all £’000 2022 Credit rating 2021 Credit rating

The expected credit loss provision is sensitive to relevant considerations that have a bearing on

judgement and estimations made with regard to the the expected future cash flows across a range of Cash and balances at central banks 286,680 P1/Aa3 240,158 P1/Aa3

selection and weighting of multiple macroeconomic economic scenarios are taken into account. These Deposits at other banks 13,931 P1/A1 12,293 P1/A1

scenarios. As a result, management has assessed and considerations can be particularly subjective and

considered the sensitivity of the provision as follows: European Investment Bank Bond 10,713 P1/Aaa 17,184 P1/Aaa

can include the business prospects for the customer,

1. The tables below show the Real Estate and the realisable value of collateral, the reliability of International Bank Reconstruction

Asset Finance ECL assuming each scenario has customer information and the likely cost and duration and Development Bonds 19,699 P1/Aaa 19,953 P1/Aaa

been 100% weighted to show the impact of of the work-out process. The level of the impairment Derivatives held for risk management purposes (1,010) P1/A1 (254) P1/A2

alternative scenarios. allowance is the difference between the value of the

discounted expected future cash flows (discounted

• Real Estate at the loan’s original effective interest rate), and its The Bank’s loans and advances to banks and debt Regular liquidity stress testing is conducted across

carrying amount. Furthermore, estimates change securities credit risk is managed through a series of a variety of scenarios covering both normal and

Current with time as new information becomes available or policies and procedures including: more severe market conditions. The scenarios are

weighted 100% as work-out strategies evolve, resulting in frequent – Cash placements – Credit risk of counterparties is developed taking into account both Bank-specific

Scenario weighting revisions to the impairment allowance as individual events (e.g., a negative media comment) and market-

Scenario ECL £000 ECL £000 decisions are taken. Changes in these estimates would controlled through the counterparty placements related events (e.g. prolonged market illiquidity,

result in a change in the allowances and have a direct policy, which limits the maximum exposure by reduced fundability of currencies, natural disasters or

1. Base Case 10,594 entity where the Bank can place cash deposits.

impact on the impairment charge. The Bank has other catastrophes).

2. Downside 16,743 Real Estate loans totalling £23.8m in Stage 3. These – Debt securities – As part of the Bank’s liquidity

14,730 loans are secured by collateral totalling £32m. A 10% buffer, it holds a portfolio of debt securities. The The Bank’s key liquidity risk management drivers

3. Severe Downside 30,130 include the following items:

increase in the LGD for these loans would result in a Bank’s internal Asset and Liability Management

4. Upside 9,641 £470k increase in the Stage 3 ECL. Policy sets limits on the value and type of – Deposit funding risk

exposures within which the Bank’s Treasury The deposit funding risk is the primary liquidity

• Credit risk function operate.

• Asset Finance risk driver for the Bank. This could occur if there

– Loans and advances to banks and debt securities

– Derivatives – Credit risk on derivatives is was a concern by depositors over the current or

Current Credit risk exists in respect of Loans and Advances controlled through a policy of only entering into future credit worthiness of the Bank. The Bank

weighted 100% to Banks and Debt securities where the Bank has contracts with a limited number of UK credit mitigates this risk with a high proportion of its

Scenario weighting acquired securities or placed cash deposits with other institutions, with a credit rating of at least BAA deposits being protected by the UK Government’s

Scenario ECL £000 ECL £000 financial institutions. No assets are held for speculative (using Moody’s long-term rating) at inception. Financial Services Compensation Scheme

purposes or actively traded. Certain liquid assets are In addition, the derivatives are collateralised (FSCS) and by having a diversified mix of deposit

1. Base Case 2,001

held as part of the Bank’s liquidity buffer. removing any credit risk. accounts with varying maturity profiles.

2. Downside 2,493

2,198 The Bank holds balances in its Bank of England reserve • Liquidity risk – Pipeline loan commitments

3. Severe Downside 2,737 account, along with a nostro accounts held with The Bank needs to maintain liquidity to cover

National Westminster Bank. The counterparties to Liquidity risk is the risk of being unable to fund

4. Upside 1,782 the outstanding pipeline of loan offers. Although

which the Bank is exposed are domestically systemic assets and meet obligations as they fall due without certain pipeline offers may not be legally binding,

banks, and as such the Bank considers that the risk of incurring unacceptable losses. the failure to adhere to an expression of intent

2. The table below shows the impact of changes to default across these balances is extremely low. The Bank’s Board of Directors sets the Bank’s to finance a loan brings reputation risk, therefore

the impairment assumptions in the IFRS 9 models. The Bank’s debt securities are currently issued by strategy for managing liquidity risk and delegates liquidity is held for such pipeline offers.

Asset Finance

the European Investment Bank (£12m) and the responsibility for oversight of the implementation

Provision International Bank Reconstruction & Development of this policy to the Assets & Liabilities Committee – Contingency funding plan

impact (£20m). The Bank considers that the loans and (ALCO). ALCO manages the Bank’s liquidity policies The Bank is required to maintain a Resolution,

Scenario £000 advances to Banks and the debt securities are of low and procedures mandated by the Board’s Risk Recovery and Liquidity Funding Contingency Plan

Residential house price increases credit risk and as such hold no specific loss provisions & Compliance Committee. The Bank’s liquidity documents by its Regulator, the PRA. The plans

by 20% more than the base case 36 against these assets. position is monitored on a day-to-day basis and involve a two-stage process, covering preventive

a summary report, including any exceptions measures and corrective measures to be invoked

Commercial property prices increase The Bank monitors its exposures to all counterparties and remedial action taken, is provided to when a potential or actual risk to the Bank’s

by 20% more than the base case on an ongoing basis and whether there have been management daily. liquidity or capital position arises from either an

any changes in the credit rating which may cause

A reduction from 40% to 35% an increase in the probability of said counterparty The Bank’s approach to managing liquidity is to internal or external event. The plans set out what

in the Bank’s forced sale discount (1,321) default. As at 31 December 2022 the Bank held no ensure, as far as possible, that it will always have actions the Bank would take to ensure it complies

with the liquidity adequacy rules and operate

A reduction of from 35% to 30% provisions against loans and advances to banks given Sufficient liquidity to meet its liabilities when they within its risk appetite and limits set by the Board.

in the assumed Cure rate 890 the low credit risk of these financial instruments, fall due, under both normal and stressed conditions,

their high propensity to meet contractual cash flow without incurring unacceptable losses, or risking – Sterling Monetary Framework facilities

A 12 month reduction in obligations as they fall due, and the instant access damage to the Bank’s reputation.

the assumed time to sell terms of these balances. The Bank is a participant in the Bank of England’s

defaulted properties (1,102) The Bank maintains a portfolio of short-term Sterling Monetary Framework facilities. The Bank

The table below sets out the credit quality of the liquid assets, largely made up of short-term liquid has drawn £78m of funding in the form of cash

A 10% increase in the Bank’s Asset Bank’s on-balance sheet loans and advances to investment securities, loans and advances to under the Bank of England’s TFSME scheme (Term

Finance LGD 179 Bank’s, debt securities and derivative assets. Full banks and other inter-bank facilities, to ensure that Funding Scheme with additional incentives for

details on the Bank’s derivative instruments can be sufficient liquidity is maintained. SME), this is repayable in September 2025.

found in Note 21.