Make commercial property deals smoother with a VAT Loan that unlocks short-term cash flow for your clients.

The flexibility of a VAT Loan can take the pressure

off cash reserves, allowing you to retain working

capital to invest in other important business areas.

As an alternative funding line, it smooths cash flow peaks

and troughs without using up existing funds.

Could this help your clients?

Here’s how it works

Business owners could take the sting out of paying upfront VAT bills on commercial property by taking out a VAT loan with us. Our solution provides a 5 month facility to SMEs, allowing them to retain valuable cash reserves for other important business areas.

We will work with businesses, assessing individual circumstances to decide if a VAT loan would be the right choice.

Example one

COMMERCIAL PROPERTY PRICE:

▶ £500,000

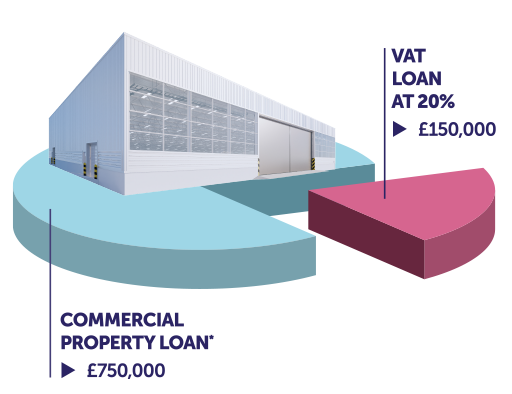

Example two

COMMERCIAL PROPERTY PRICE:

▶ £750,000

Please note these examples do not include any additional fees.

Key features

Funding for up to 100% of the VAT bill due to HMRC

Only available in conjunction with a new Cambridge & Counties Bank commercial loan*

Maximum 5 month term or until the next rebate is due

Lending criteria

*A VAT Loan is not available for commercial bridging and commercial refurbishment loans.

Get in touch with our experienced team

For properties in Scotland, our minimum loan size is currently £500k, while for the rest of the country, it is £250k. We understand the unique financial landscape in Scotland and, subject to our standard lending criteria (which can be found on our website), we are open to discussions on tailoring finance solutions to meet specific requirements. For enquiries, please send us a message using the form below.

For general enquiries please contact:

Existing customers please contact: