What is an Energy Performance Certificate (EPC)?

An Energy Performance Certificate (EPC) gives detailed information about a property’s energy efficiency and likely carbon dioxide emissions. They are issued to comply with the Minimum Energy Efficiency Standards (MEES).

To receive an EPC, an Energy Assessment Survey must be carried out at the property. An Assessor of an approved organisation will perform internal and external inspections to determine how energy efficient the building is and what possible level of efficiency is achievable if improvements are made.

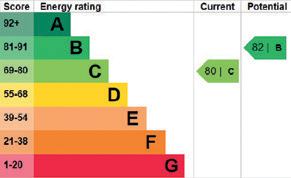

Once the Assessor of an approved organisation has performed a full inspection, they will put together an EPC and grade the property’s energy performance: ‘A’ being the most efficient and ‘G’ being the least.

Energy Efficiency Rating

An energy efficiency rating is based upon a ‘Standard Assessment Procedure’ with a score between 1 – 100 (SAP points); domestic ratings also include a potential score if defined improvements are made to the property, e.g. insulation, new boiler or double-glazing.

Are there different types of EPCs?

The certification process is slightly different between domestic and non-domestic (commercial) properties.

A domestic energy performance certificate

This will give you an overall energy rating and an environmental impact rating, including an indication of its potential grading. You will need to supply it when you build, let or sell a property.

A commercial energy performance certificate

This is needed when you're building, letting or selling a commercial building such as an office, retail outlet or factory. A commercial EPC is very similar to a domestic EPC, but it has a more detailed assessment. Public buildings also need to have a Display Energy Certificate (DEC) presented in an assessable place in the building.

Multi-Unit Blocks (“MUBs”)

MUBs differ from an HMO in that they contain separate, independent residential units, each with their own AST agreement. As such, each MUB will require its own EPC for each unit, whereas a HMO will require one EPC for the property in its entirety.

Where can I find an existing EPC?

England and Wales

EPC Registers for England and Wales are publicly available at for both domestic (residential) and non-domestic

(commercial) properties.

Scotland

EPCs relating to domestic and non-domestic properties in Scotland.

How long is an EPC valid?

An EPC is valid for ten years.

Once an EPC reaches the ten-year point and expires, there is currently no automatic requirement for a new one to be commissioned. A further EPC will only be required the next time a trigger point is reached, i.e. when the property is next sold or let to a new tenant.

Compliance notices & penalties

It is a legal obligation to have an EPC if you build, let or sell a domestic or commercial property, and failure to obtain an EPC can result in penalties. A Local Authority may serve a compliance notice requesting information to help them decide whether a breach has occurred. They may serve a compliance notice up to 12 months after a suspected breach occurred. A fine up to £5,000 per property could be levied. In addition, there are several regulations that landlords need to be aware.

Current Regulations

England & Wales (as at 25/5/2022)

Residential properties

From 1 April 2020, landlords can no longer let or continue to let privately rented properties covered by the MEES Regulations if they have a current EPC rating below E, unless they have a valid exemption in place.

Commercial properties

From 1 April 2018, a landlord must not grant a new tenancy (including a renewal tenancy) of a property if the EPC has a current rating below E, unless they have a valid exemption in place. From 1 April 2023, a landlord must not continue to let any property where the property energy rating remains below the E threshold.

Energy rating grade below “E”

If a property doesn’t meet the EPC requirement of ‘E’ or above, there is a legal responsibility on the landlord to carry out the changes suggested in the EPC report, subject to certain exemptions detailed below.

If an exemption certificate is approved, then it is valid for a maximum of five years. Guidance for exemptions can be found here.

Exemption criteria - residential

If a landlord cannot improve their property to EPC ‘E’ from expenditure up to £3,500 (Incl. VAT), they should make all the improvements which can be made up to that amount, then register an ‘All improvements made’ exemption.

If no improvement can be made because the cost of installing even the cheapest recommended measure would exceed £3,500 (including VAT), a ‘High cost’ exemption should be registered.

Exemption criteria - commercial

Another common exemption is the ‘7-year payback’ exemption. This would apply if a landlord can show that the cost of purchasing and installing any recommended improvements does not meet a simple 7-year payback test, i.e., where the expected value of savings on energy bills that the measures are expected to achieve over a period of 7 years are less than the cost of repaying it.

Other exemptions for domestic, non-domestic or both include but are not limited to:

- Places of worship

- Temporary buildings that will be used for less

than 2 years - Stand-alone buildings with total floor space of

less than 50 square metres - Industrial sites, workshops and non-residential

agricultural buildings that do not use a lot

of energy - Some buildings that are due to be demolished

- Holiday accommodation that’s rented out for less than 4 months a year or is let under a licence to occupy

- Listed buildings – you should get advice from your local authority conservation officer if the work would alter the building’s character. Listed buildings should have an EPC but will be able to apply for an exemption where the requirements would unacceptably alter it

- Residential buildings intended to be used less than 4 months a year

The above only relates to properties in England & Wales. For current regulations in Scotland, please click here.

Future Regulations being considered

Residential properties

The UK Government has committed to be carbon net-zero by 2050. After a consultation in December 2020, the government has proposed that all privately rented domestic properties have an EPC rating of ‘C’ or above by 2025 where practical, costeffective, and affordable.

As with previous changes, the new regulations will be introduced for new tenancies first, followed by all existing tenancies from 2028. Separate consultations will be undertaken for non-Domestic privately rented properties.

The penalty for not having a valid EPC could also be raised from £5,000 to £30,000 from 2025, and the maximum expenditure increased from £3,500 to £10,000 before an exemption is granted.

Commercial properties

In 2020 the government outlined in a white paper the steps required over the next 10 years in meeting its commitments to net zero carbon emissions by 2050. There are two significant compliance windows, which landlords need to have noted.

Compliance window one

1st April 2025

Landlords will be required to submit a valid EPC by this date or provide an updated version if it’s expired (EPCs last for 10 years). The landlord will need to undertake any works to ensure the EPC rating is C or above by 1st April 2027 or have registered a valid exemption.

Compliance window two

1st April 2028

Landlords will be required to submit a valid EPC by this date. The landlord will need to undertake any works to ensure the EPC rating is B or above or have registered a valid exemption by 1st April 2030.

Scotland Regulations

Rules/timelines are slightly different in Scotland, as follows:

- From 1st April 2020, a private rented property was required to have an EPC rating of at least E when any new tenancy agreement starts.

- From 31st March 2022, all rental properties need to be at least EPC band E.

- From 1st April 2022, any new tenancy agreement requires the property to have an EPC of at least band D.

- From 31st March 2025, all rental properties will need to have at least EPC band D.

Exemptions in Scotland

The only buildings which do not require an EPC are:

- standalone buildings (other than dwellings) with a useful floor area of less than 50 m²

- temporary buildings with a planned use of two years or less

- buildings with a low energy demand, i.e., nonresidential agricultural buildings and workshops

- buildings sold for the purpose of demolition.

Note: 'Places of worship' and historic buildings are not subject to an exemption in Scotland. Currently there is no exemption register for Scotland.

To find out more, contact:

www.gov.uk/government/collections/energy-performance-certificates

Haven’t quite found what you’re looking for?

Get in touch with our experienced team or take a look at our Useful documents and FAQs page.

Already a customer?

Take a look at our existing customers FAQs or contact us: